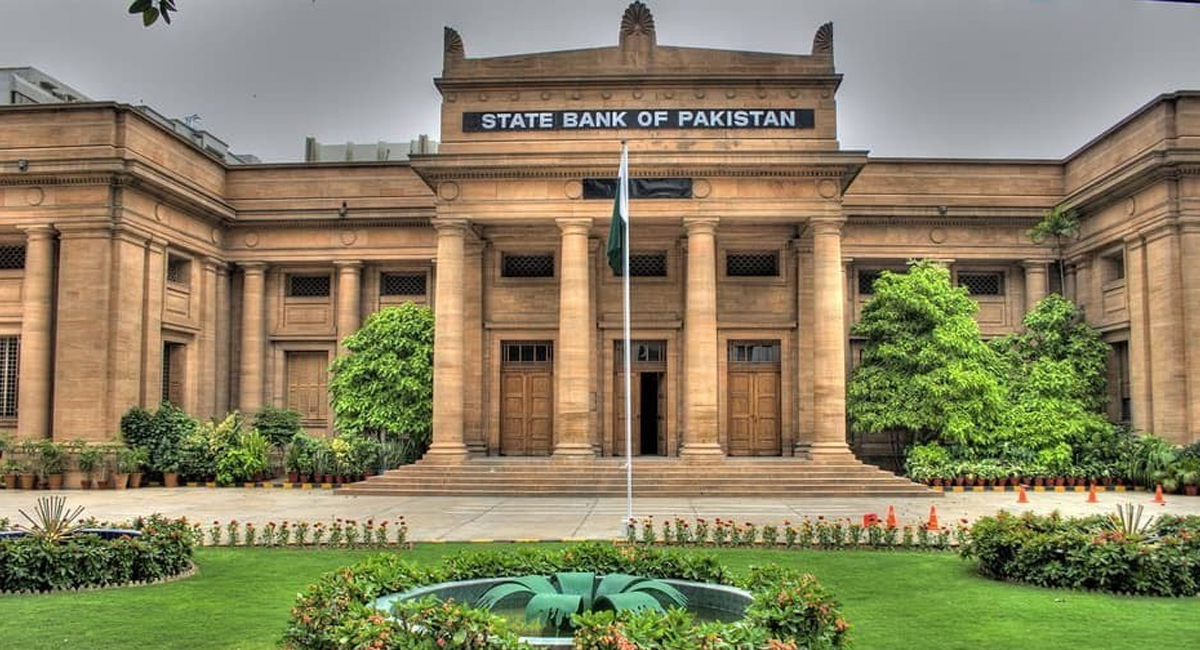

KARACHI: The State Bank of Pakistan (SBP) has taken a significant step in its monetary policy by reducing the key interest rate by 150 basis points (bps), bringing it down to 20.5%. This decision, announced on Monday, follows a series of seven sessions and is poised to have far-reaching impacts on the economic landscape of Pakistan. The cut comes at a critical juncture, ahead of the annual budget, and shortly after recent data indicated a substantial decline in inflation to a 30-month low of 11.8% in May.

Understanding the Rate Cut Decision

Economic Context and Inflation Trends

The SBP’s decision was informed by the Monetary Policy Committee (MPC), which met earlier today to evaluate current economic conditions. A key factor influencing the rate cut was the “better than anticipated” decline in inflation observed in May. The MPC highlighted that underlying inflationary pressures are beginning to ease, thanks to a stringent monetary policy and ongoing fiscal consolidation.

However, the MPC also pointed out potential upside risks to the near-term inflation outlook. These risks are associated with impending budgetary measures and uncertainties surrounding future energy price adjustments. Despite these concerns, the current inflation rate of 11.8% represents a significant improvement, giving the SBP confidence to lower the policy rate.

Key Economic Developments and Their Implications

Moderate GDP Growth

The committee noted that real GDP growth remains moderate at 2.4%. This growth rate reflects a subdued recovery in the industrial and services sectors, which have partially offset the robust growth observed in agriculture. The balance between these sectors is crucial for maintaining steady economic progress.

Current Account Deficit and Foreign Exchange Reserves

A noteworthy development is the reduction in the current account deficit, which has played a vital role in bolstering Pakistan’s foreign exchange reserves. The reserves now stand at approximately $9 billion, despite substantial debt repayments and weak official inflows. This improvement in FX reserves is crucial for maintaining economic stability and supporting the country’s financial obligations.

The Real Interest Rate and Inflation Targeting

The SBP emphasized that the real interest rate remains significantly positive. This positive real interest rate is instrumental in guiding inflation towards the medium-term target range of 5-7%. By maintaining a positive real interest rate, the SBP aims to keep inflationary pressures in check while promoting economic stability.

The Role of the IMF and Financial Inflows

The government of Pakistan has approached the International Monetary Fund (IMF) for an Extended Fund Facility (EFF) programme. This programme is expected to unlock financial inflows that will further enhance the build-up of FX buffers. Access to IMF resources will provide additional financial support, helping Pakistan navigate its economic challenges more effectively.

Market Reactions and Survey Insights

The decision to cut the policy rate by 150bps defied market expectations. According to a survey conducted by Topline Securities, 43% of participants anticipated a 100bps decline, while a Bloomberg survey indicated that 63% of respondents expected a similar reduction. The SBP’s more aggressive rate cut underscores its proactive stance in addressing economic challenges and fostering a conducive environment for growth.

Impact on Various Economic Sectors

Banking and Financial Services

The rate cut is expected to have significant implications for the banking and financial services sector. Lower interest rates generally lead to increased borrowing and lending activities, stimulating economic growth. Banks may experience a boost in loan demand, which can contribute to higher profitability and expansion of financial services.

Real Estate and Construction

The real estate and construction sectors are likely to benefit from the reduced policy rate. Lower interest rates can make mortgages and construction loans more affordable, potentially leading to increased investment in housing and infrastructure projects. This, in turn, can stimulate job creation and economic development.

Manufacturing and Industry

For the manufacturing and industrial sectors, the rate cut could result in lower borrowing costs for businesses. This can encourage capital investment, expansion of production capacities, and overall industrial growth. Companies may find it more feasible to undertake new projects and upgrade existing facilities, contributing to economic dynamism.

Potential Challenges and Considerations

Inflationary Pressures

Despite the positive outlook, there are potential challenges associated with the rate cut. The MPC has acknowledged upside risks to inflation, particularly related to budgetary measures and energy prices. Managing these risks will be crucial to ensuring that inflation remains within the targeted range.

Global Economic Environment

The global economic environment also poses uncertainties that could impact Pakistan’s economic trajectory. Fluctuations in global commodity prices, trade tensions, and geopolitical developments are factors that need to be monitored closely. These external influences can affect Pakistan’s economic stability and growth prospects.

Conclusion

The State Bank of Pakistan’s decision to cut the key policy rate by 150bps to 20.5% marks a significant shift in the country’s monetary policy. This move, driven by a notable decline in inflation and improvements in foreign exchange reserves, aims to foster economic growth and stability. While there are potential risks to consider, the proactive approach taken by the SBP reflects its commitment to navigating the economic landscape effectively.